The global gemstone trade has long been shrouded in complexities, particularly when it comes to the legal procurement and cross-border movement of rough stones. In recent years, a growing trend known as "mine-direct purchasing" has emerged as a game-changer for industry players seeking transparency and compliance. This model allows buyers to source rough gemstones directly from mining sites, cutting out middlemen while ensuring adherence to international regulations.

Understanding Mine-Direct Purchasing

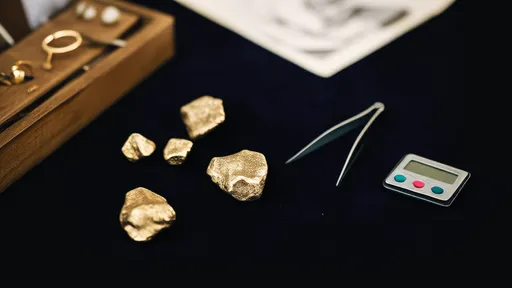

The concept of purchasing rough stones directly from mining operations represents a significant shift from traditional gemstone trading practices. Historically, the journey from mine to market involved numerous intermediaries, each adding layers of cost and potential regulatory gaps. Mine-direct transactions create a more streamlined supply chain where buyers can verify the origin and legal status of their purchases firsthand.

This approach has gained particular traction among ethical jewelers and large-scale manufacturers who prioritize both quality assurance and responsible sourcing. By establishing direct relationships with mining cooperatives or licensed operations, buyers gain unprecedented visibility into extraction methods, labor conditions, and environmental impact. The model proves especially valuable for rare or high-value stones where provenance significantly affects market value.

Navigating Legal Frameworks

Legal compliance forms the cornerstone of successful mine-direct transactions. Each country maintains distinct regulations governing mineral rights, export permits, and royalty payments. In major gem-producing nations like Colombia (emeralds), Myanmar (rubies), or Tanzania (tsavorite), recent legislative reforms have specifically addressed artisanal mining sectors to bring them into formal trade channels.

Export documentation typically requires chain-of-custody records that trace the stone's path from extraction point to border crossing. Many governments now mandate geological certificates that confirm the stone's natural origin alongside tax clearance documents. The Kimberly Process Certification Scheme, while primarily targeting diamonds, has influenced broader industry standards for rough stone verification.

Customs authorities in both exporting and importing nations have intensified scrutiny of mineral shipments. X-ray fluorescence scanners and spectroscopic analysis now commonly verify declared contents against actual composition. Some jurisdictions require rough stones to be shipped in transparent, tamper-evident containers with embedded tracking chips.

Operational Challenges and Solutions

Despite its advantages, mine-direct purchasing presents unique logistical hurdles. Remote mining locations often lack proper infrastructure for secure storage or transportation. Seasonality affects availability, as many deposits become inaccessible during rainy seasons. Political instability in certain regions can disrupt carefully planned supply chains overnight.

Forward-thinking buyers address these challenges through several strategies. Some establish local processing facilities near mines to transform rough stones into cuttable parcels before export. Others partner with logistics specialists who manage everything from armored transport to temperature-controlled storage. Digital platforms now enable virtual stone inspections via 3D scanning, reducing the need for repeated site visits.

The due diligence process has become increasingly sophisticated. Reputable buyers employ geologists who can identify treated or synthetic materials disguised as natural rough. Blockchain-based tracking systems are gaining adoption, with each transaction recorded in immutable ledgers that include mining coordinates, worker identification, and environmental impact assessments.

Market Impact and Future Trends

The rise of mine-direct purchasing has begun reshaping traditional gemstone markets. Auction houses report increased demand for "story stones" with fully documented provenance. Cutting centers in traditional hubs like Idar-Oberstein or Jaipur now compete with localized processing near mines in Africa and South America.

Consumer awareness drives much of this transformation. Millennial and Gen Z buyers increasingly demand ethical sourcing guarantees, with many willing to pay premiums for stones with verifiable histories. This has led to innovative marketing approaches where purchasers can virtually "meet the miners" through augmented reality experiences or track their stone's journey via QR codes.

Looking ahead, industry analysts predict further integration of technology into mine-direct models. Artificial intelligence may soon assist in predicting yield quality from rough stones, while drone technology could revolutionize deposit mapping. As sustainability concerns grow, carbon-neutral mining operations might command price advantages in the direct-purchase marketplace.

The mine-direct approach doesn't eliminate all risks—price volatility, quality variations, and geopolitical factors remain—but it offers a more controlled environment for managing them. For serious players in the gemstone trade, building direct sourcing relationships has transitioned from competitive advantage to business necessity in an era where transparency equals value.

By /Aug 11, 2025

By /Aug 11, 2025

By /Aug 11, 2025

By /Aug 11, 2025

By /Aug 11, 2025

By /Aug 11, 2025

By /Aug 11, 2025

By /Aug 11, 2025

By /Aug 11, 2025

By /Aug 11, 2025

By /Aug 11, 2025

By /Aug 11, 2025

By /Aug 11, 2025

By /Aug 11, 2025

By /Aug 11, 2025

By /Aug 11, 2025

By /Aug 11, 2025

By /Aug 11, 2025

By /Aug 11, 2025

By /Aug 11, 2025