The world of independent jewelry design thrives on creativity, but its foundation lies in the meticulous sourcing of precious metals. For designers operating outside major jewelry houses, gold procurement presents both opportunities and challenges that directly impact their craft and bottom line. Unlike mass-market manufacturers, these artisans must navigate fluctuating markets with limited capital while maintaining ethical and quality standards that align with their brand ethos.

Current gold market dynamics create a complex landscape for independent designers. The spot price of gold remains volatile, influenced by global economic uncertainty, inflation fears, and currency fluctuations. While large manufacturers hedge against price swings through futures contracts, most independents lack the resources for such financial instruments. This exposes them to sudden cost increases that can disrupt carefully planned collections. Many designers now monitor COMEX futures as part of their daily routine, watching for patterns that might signal favorable buying windows.

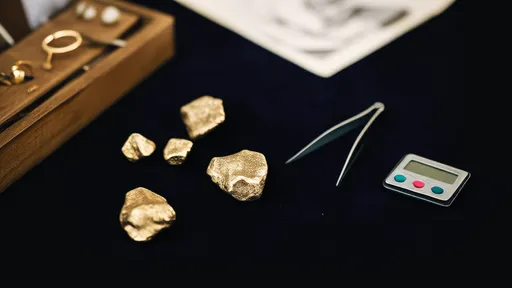

The physical form of purchased gold significantly affects both creative possibilities and production costs. Sheet gold, preferred for many fabrication techniques, carries different premiums compared to casting grain or wire. Some designers report that buying from specialized mills rather than general bullion dealers yields better pricing on specific forms, though minimum order quantities often present hurdles. The rise of 3D printing in jewelry has also shifted demand toward high-purity gold powders, creating new sourcing considerations for tech-savvy designers.

Ethical sourcing has transitioned from niche concern to business imperative in the design community. Clients increasingly demand transparency about mining practices, forcing independents to scrutinize supply chains they once took for granted. While responsibly mined gold certifications exist, the paperwork and premiums involved strain small operations. Some designers have formed buying cooperatives to meet minimums for ethical gold, while others turn to recycled sources despite sometimes compromising on alloy consistency. The ethical dimension adds both moral satisfaction and logistical complications to the procurement process.

Regional variations in gold purchasing reveal fascinating adaptations. European designers frequently leverage historic jewelry districts like Milan's Via Orefici for immediate access to multiple suppliers. North American independents more often rely on online platforms offering overnight shipping, accepting higher premiums for convenience. In emerging markets, some designers bypass commercial suppliers entirely, working directly with local refiners or even processing artisan-mined gold—a practice raising both quality control issues and unique storytelling opportunities for their brands.

Payment structures in gold procurement create subtle financial pressures. Suppliers increasingly demand cryptocurrency or wire transfers for larger orders, while smaller designers still rely on credit cards accepting the 2-3% processing fee as a cost of doing business. Some veteran designers strategically time purchases to credit card billing cycles, effectively gaining an interest-free short-term loan. These financial gymnastics highlight the cash flow challenges facing independents in a commodity-driven industry.

The secondary market for gold scrap plays an underappreciated role in many designers' material strategies. Rather than selling their bench filings and failed castings to refiners at steep discounts, some create internal recycling systems. One Los Angeles-based designer developed a small induction furnace to reprocess scrap in-house, regaining control over alloy composition while reducing new gold purchases by nearly 40%. Such innovations demonstrate how resource constraints can spark technical ingenuity.

Looking ahead, blockchain technology promises to revolutionize gold tracking for designers. Several startups now offer digitally tokenized physical gold, allowing purchase in gram increments with verified custody chains. While currently limited to investment-grade bullion, the model could expand to fabrication-grade material, giving independents unprecedented flexibility. As one London designer noted, "Being able to buy two grams of ethically sourced 18k white gold at 3am to finish a commission would change everything about how we work."

Ultimately, gold procurement for independent designers represents far more than a simple transaction. It's a continuous balancing act between artistic needs, financial realities, and ethical commitments—one that separates surviving designers from thriving ones. Those who master its nuances gain not just raw material, but competitive advantage in an industry where provenance and cost management increasingly define success.

By /Aug 11, 2025

By /Aug 11, 2025

By /Aug 11, 2025

By /Aug 11, 2025

By /Aug 11, 2025

By /Aug 11, 2025

By /Aug 11, 2025

By /Aug 11, 2025

By /Aug 11, 2025

By /Aug 11, 2025

By /Aug 11, 2025

By /Aug 11, 2025

By /Aug 11, 2025

By /Aug 11, 2025

By /Aug 11, 2025

By /Aug 11, 2025

By /Aug 11, 2025

By /Aug 11, 2025

By /Aug 11, 2025

By /Aug 11, 2025